The Healthcare Quandry

Most of my career was spent in healthcare, working in IT for providers, coordinating third party payments, and being a consumer battling with crazy multi-layered payment systems. I was lucky enough to be healthy in my youth and get by without insurance (although my feet still point in different directions thanks to breaking my ankle and not going for treatment). I have clear experience with seeing how the system is so badly broken, and it seems to me we’re not addressing the actual problems.

I feel like people miss the point of the ACA, which was a first draft at controlling costs and a start to healthcare reform. I also believe that repealing it will do more damage than simply starting to address the shortcomings and work on reforming the actual problem.

First: a history lesson on the economics of healthcare providers. In the “good old days”, there was no health insurance. People who needed a doctor went to see one, and the providers for the most part worked in that industry because they wanted to help people. They generally charged enough to cover their costs and continue to make a decent living. And if their costs went up, they simply raised their rates.

At some point, employers realized that providing real healthcare insurance was good for them: healthy employees were more productive, and it was a perk they could offer to attract and retain talent. It wasn’t all common, until after World War II, when the War Labor Board granted a tax exemption to prevent a massive strike against wage controls.

The next big step in the evolution of health care was also an accident. In 1943, the Internal Revenue Service ruled that employer-based health care should be tax free. A second law, in 1954, made the tax advantages even more attractive.

By the sixties, the consumer was pretty insulated from healthcare costs if they worked somewhere with insurance, and employers just viewed the premiums as the price they paid for doing business (and a very attractive one at that). This nascent market was very competitive, and costs hadn’t grown out of control yet.

One unintended consequence of this intermediation was that the provider payment was now abstracted away from the patient and doctor relationship. Now the doctor had to deal with a business who needed to run to some extent like an insurance company: increase income, and decrease what they pay out in order to they could be profitable. So instead of direct negotiation (“Hey I can’t afford this” from the patient, or “Procedure X is cheaper, but Y is better for you”), you have a business trying to simply cut payment for each service, while trying to maximize premiums from the employer.

Don’t get me wrong there were some good things that came out of this: the payers normalized doctor costs, so it was more difficult for a doctor to gouge the consumer. Experiments in preventative healthcare like Kaiser were also great ideas at first.

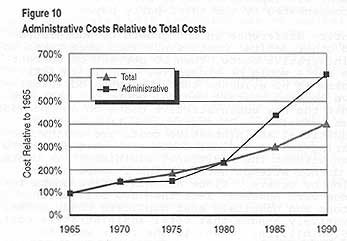

The main problem is that there are so many intermediaries in this process all trying to make a profit, that everything is insanely inflated. You work for an employer who gives you health insurance (for a tax break), and takes a small part of that out of your

paycheck (I assume with the idea of letting you know how expensive it really is). They pay the first intermediary (third-party payer or TPP) that we call the insurance company. That payer manages your claims when you use the medical insurance. In the “good old days” most providers would simply bill the insurance for the claim. now unless the TPP already has a relationship with them (and collect your “co-pay”), they make sure to ask you to acknowledge you are responsible for it first. After a while these TPP’s got so pushy that individual providers were no longer able to handle all the paperwork and negotiations, so enter TPP #2, the provider billing entities. These entities take a fee to do the billing (make sure claims have been coded properly, deal with the other TPP, etc).

So now we have the employer, and at least two TPP’s between the consumer and the provider. But wait, it gets worse – the first TPP wants to reduce payment so they work hard to deny, delay claims, and/or adjust them down. And the second TPP needs to maximize the payment for their profit motive, so they want the claims paid quickly and for the largest amount possible. So of course with this friction we end up with each of these TPP’s getting other intermediaries involved: collection and billing agencies.

Because the provider is waiting months for the payment to flow through the fight between TPP #1 and TPP #2, they hire bill collectors as well. All of these intermediaries break the provider’s relationship with the patient, and increase costs. Now a patient is on the phone with their insurance, trying to figure out why the bill isn’t paid, getting calls from various intermediaries and bill collectors all with different motives, and getting a straight answer as to whether the doctor actually got paid is next to impossible (anybody remember the “whisper” game ?)

The problem, as I see it, is we continue to commingle terms and give a nod to third-party payers by calling them insurance companies under the mistaken assumption that since it’s insurance it should work like insurance.

Insurance is a business that reduces liability by spreading risk over time (and population). You have car insurance because you couldn’t afford to have somebody sue you in the unlikely event that you hurt, killed or maimed somebody (or their property).

Because most people will never really need to fully use their insurance, the insurance company can make money by spreading that risk across all the people who buy it. If you’re a really bad driver, they can eventually say you’re too high of a risk and refuse to insure you.

Even in this case, though, we as a society have decided that we don’t want to assume the risk for the uninsured, so we mandate insurance for all drivers, effectively reducing the cost for the rest of us (and increasing the profit for the insurance company).

So if these companies were really insurance companies, they’d be insuring us against the unacceptable risk of catastrophic events.

So what about preventive care ? Well, in a true insurance model, you’d get a “good patient” discount just like with car insurance, and a “bad driver” rate if you don’t do the preventative work.

So we need to use a different term for that part of the third-party payer system. These are the things that we all should be doing to reduce cost, so linking them indirectly makes sense. And because not all of us can afford to go to the doctor for checkups and routine visits, those people are more expensive for the insurance part of the formula.

In my youth, I was guilty of waiting until I needed to go to the ER before seeing a doctor. This is not uncommon with people without a third-party payer to spread their costs, since out-of-pocket for a doctor visit is incredibly expensive when most of your check is gone for feeding and housing yourself.

Which leads me to believe that we as a society need to make sure that everybody has basic preventive care as well as insurance for catastrophic events. One is useless without the other, since we as a society insist on providing emergency care without regard for ability to pay (as I would hope we would continue to do).

So let the third-party payers stop providing insurance, and use real insurance companies for that.

Can Congress please stop trying to point fingers at the ACA, or thinking that some magic bullet of repealing it will fix the problem, and work on things that will actually fix what’s broken ?